Tony Davidow, Vice President, Alternative Beta & Asset Allocation Strategist, Schwab Center for Financial Research sits down with Julie Cooling, Founder & CEO, RIA Channel to discuss working with financial advisors to help them differentiate strategic beta strategies.

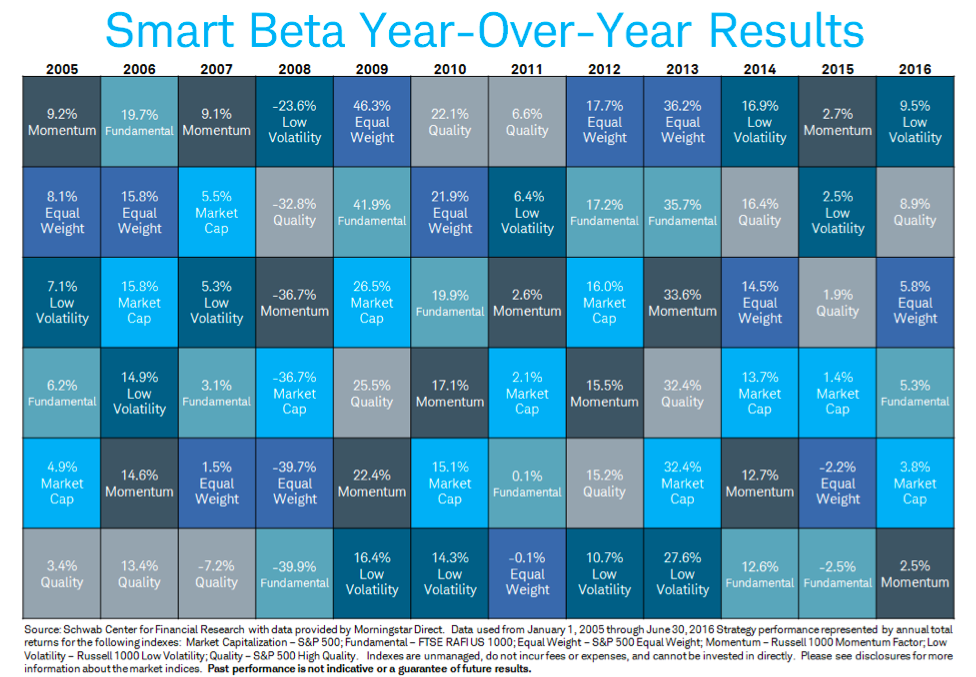

Davidow emphasizes the importance of understanding the differences between low volatility, momentum and fundamental smart beta strategies, and how each may correlates with other traditional asset classes. For instance, fundamental smart beta is more of a value strategy that may work well with other capitalization weighted core holdings. Per Davidow, momentum smart beta strategies behave similarly to traditional growth strategies. Each strategy works differently, and advisors work closely with Schwab’s independent think tank to assist in customizing portfolios appropriately for clients. Performance of smart beta strategies rotate based on market conditions as depicted in the following chart:

The Schwab Center for Financial Research provides investment research and acts as an independent resource for advisors.